Russia is set to default on its debts 'imminently' as sanctions smash the country's economy, Fitch Ratings warns

- Fitch Ratings on Tuesday again downgraded Russia's sovereign debt rating

- It warned the country could soon default on its debts amid Western sanctions

- Russia's economy has been pummelled since Putin ordered invasion of Ukraine

- As of the morning of March 9, $1USD was equal to 133 Russian roubles. Before the invasion on February 24, the value was around 84 roubles to $1USD

- Click here for MailOnline's liveblog with the latest updates on the Ukraine crisis

By CHRIS JEWERS FOR MAILONLINE and AFP

PUBLISHED: 19:54 AEDT, 9 March 2022 | UPDATED: 19:59 AEDT, 9 March 2022

Russia will default on its debts 'imminently', a leading credit rating agency has warned, as sanctions over Ukraine continue to pummel the country's economy.

The warning came from Fitch Ratings on Tuesday which again downgraded Russia's sovereign debt rating farther into junk territory from 'B' to 'C,' saying the decision reflects the view that a default is 'imminent.'

Like other major ratings agencies, Fitch had already slashed Russia's rating earlier this month to 'junk' status - which is the category of countries at risk of not being able to repay their debt.

'The 'C' rating reflects Fitch's view that a sovereign default is imminent,' the agency said in a statement, adding its new downgrade came because recent developments had 'further undermined Russia's willingness to service government debt.'

Russia's financial markets have been thrown into a turmoil by Western sanctions after President Vladimir Putin ordered the invasion of Ukraine, raising significant concerns over its ability and willingness to pay its debts.

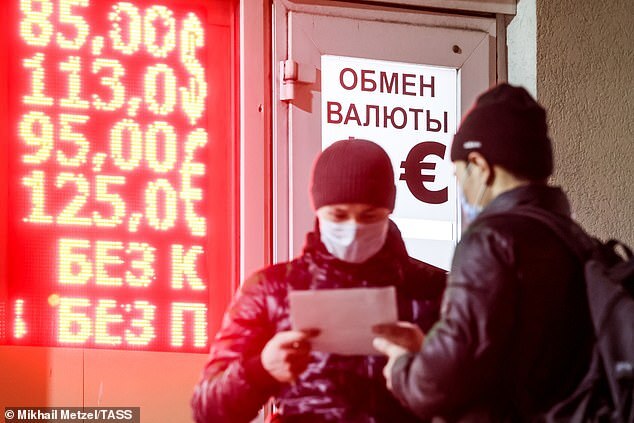

Pictured: Men are seen by a digital board showing Russian rouble exchange rates against the euro and the US dollar outside a currency exchange office. A ratings agency warned today that Russia could soon default on its debts as sanctions continue to pummel its economy

The agency said 'the further ratcheting up of sanctions, and proposals that could limit trade in energy, increase the probability of a policy response by Russia that includes at least selective non-payment of its sovereign debt obligations.'

The rating firm pointed to Presidential decree, which could potentially force a redenomination of foreign-currency sovereign debt payments into local currency for creditors in specified countries.

'This rating action follows our downgrade of the Long-Term Foreign-Currency IDR to 'B'/Rating Watch Negative on 2 March, and developments since then have, in our view, further undermined Russia's willingness to service government debt,' Fitch said.

'This includes the Presidential Decree of 5 March, which could potentially force a redenomination of foreign-currency sovereign debt payments into local currency for creditors in specified countries.'

On Tuesday, the United States and Britain announced they were cutting off Russian energy imports - the US ban is effective immediately, while London said it would phase out oil imports by the end of the year.

If Russia were to default on a debt payment, it would be the first time since 1998.

A country defaulting on its debts can have a knock-on effect on other economies, particularly those with close financial ties.

In light of the war in Ukraine and the sanctions being imposed, several countries are working to cut any dependencies they have on Russia - particularly on its resources such as gas and oil - but also other business links.

Speaking to the BBC, Shane Oliver of investment management company AMP Capital said he believed Russia was effectively already defaulting on its debts.

He also said that the knock-on effect on other nations should be minimal.

Defaulting 'will only service it in much depreciated roubles anyway and foreign investors are offloading it at fire sale prices. Fortunately the global exposure to it is relatively low,' he told the broadcaster.

An employee looks at a stock price index graph showing plunging stock prices on an electronic information screen at the headquarters of the Micex-RTS Moscow Exchange (file)

Russia's financial markets have been thrown into a turmoil by Western sanctions after President Vladimir Putin ordered the invasion of Ukraine, raising significant concerns over its ability and willingness to pay its debts. Pictured: A destroyed Russian tank in Ukraine, Tuesday

What happens when a country defaults?

Fitch Ratings agency warned Wednesday that Russia could default on its debt, as Western sanctions continue to take their toll.

When a government is unable to meet its sovereign debt repayments - by being unable or unwilling to make good on its fiscal promises or repay its bondholders - then it is said to be in 'default'.

Russia is among countries to have defaulted in the past, doing so in 1998. Argentina and Lebanon are among the others to have done so.

What follows is usually a complete market and international collapse of confidence in the country's economy.

The market - aware of the issues being faced by the country - sell off its currency, causing its value to plummet, as was the case with the rouble in 1998.

As when an individual cannot repay their debts, a country defaulting also makes it more difficult and expensive to borrow funds.

But the most damaging impact can be on the country's people. When a country's borrowers face dramatically higher payments on things such as mortgages, then they have far less disposable income.

Even without the government defaulting, this is already the case in Russia. With the value of the rouble plummeting in recent weeks, the average Russian is already seeing prices of goods skyrocket.

A debt default can also have a knock-on effect on other economies - particularly those which own much of the country's debt.

This can prompt other countries to help bail out a defaulting country, as the United States did for Mexico in the mid-1990s, or as the EU did for Greece during the 2008 global crash.

On March 16, Russia is due to pay $107 million in coupons across two bonds, though it has a 30-day grace period to make the payments.

The 'C' rating in Fitch's assessment is only one step above default, bringing it in line with the Moody's current equivalent score of 'Ca'.

Peers Moody's and S&P had also lowered their sovereign ratings of Russia.

The country is facing the gravest economic crisis since the 1991 fall of the Soviet Union after crippling sanctions were imposed on almost its entire financial and corporate system.

As of the morning of March 9, $1USD was equal to 133 Russian roubles. Before the invasion on February 24, the value was around 84 roubles to $1USD - demonstrating its rapid value collapse.

The government has more than doubled its interest rate to 20 percent in an attempt to stop its currency's value from deteriorating further.

On Wednesday, Russia warned the West that it was working on a broad response to sanctions that would be swift and felt in the West's most sensitive areas.

'Russia's reaction will be swift, thoughtful and sensitive for those it addresses,' Dmitry Birichevsky, the director of the foreign ministry's department for economic cooperation, was quoted as saying by the RIA news agency.

U.S. President Joe Biden on Tuesday imposed an immediate ban on Russian oil and other energy imports in retaliation for the invasion.

Russia warned earlier this week that oil prices could shoot up to over $300 per barrel if the United States and European Union banned imports of crude from Russia.

Russia says Europe consumes about 500 million tonnes of oil a year. Russia supplies around 30 percent of that, or 150 million tonnes, as well as 80 million tonnes of petrochemicals.

Russian President Vladimir Putin says the 'special military operation' is essential to ensure Russian security after the United States enlarged the NATO military alliance to Russia's borders and supported pro-Western leaders in Kyiv.

Ukraine says it is fighting for its existence and the United States and its European and Asian allies have condemned the Russian invasion.

China, the world's second largest economy, has called for restraint but President Xi Jinping has cautioned that sanctions will slow down the world economy.

Pictured: Empty shelves at a Lenta supermarket in Irkutsk, Siberia as Western sanctions bite

Consumers are being told to limit the number of items in their shopping basket to ensure there is enough food to go around

As of the morning of March 9, $1USD was equal to 133 Russian roubles. Before the invasion on February 24, the value was around 84 roubles to $1USD - demonstrating its rapid collapse

Yesterday, it was reported that anger was growing in Russia over its economic situation as frustrated shoppers found some shelves empty.

The Kremlin is desperately trying to crack down on any dissent to the brutal invasion of Ukraine and a total of 13,500 demonstrators have now been arrested since the war was waged, 100 of them today.

Anti-Putin sentiment is hitting the high street with consumers told to limit the number of items in their shopping baskets as sanctions start to bite.

Some say they may have to leave the country to secure a better life for their families, with Russians facing a return to the hardships of the 1990s when the country experienced food queues and hyperinflation after the fall of the Soviet Union.

One notice to shoppers in St Petersburg read: 'It is important that there are enough goods for everyone. We are forced to temporarily impose restrictions on high-demand goods. Up to ten pieces per purchase.'

There are suggestions that some groceries are already being rationed by Vladimir Putin who is anticipating a prolonged period without the normal influx of Western goods and money.

Major retailers such as Zara, H&M, Ikea and many others have also suspended sales in Russia, closing their doors in many shopping centres in the capital Moscow.

The world's top fashion houses such as Gucci, Prada, Dior and Fenti also shut from Monday.

Meanwhile Michelle Bachelet, the top UN human rights official said the ability to criticise public policy in Russia, particularly for its decision to invade Ukraine, is 'narrowing' because of the 'unlawful' detentions.

Share or comment on this article:

Fitch: Russia is set to default on its debts 'imminently' as sanctions smash the country's economy

'The Citing Articles' 카테고리의 다른 글

| “참관인 도장이 왜 없냐고” “천장에 의문의 구멍이…” 투표소 곳곳 소동 (0) | 2022.03.09 |

|---|---|

| '우크라 전투기 지원' 美-폴란드 확전 부담에 '핑퐁 게임' (0) | 2022.03.09 |

| "내가 이미 했다고?"..투표 못 하고 돌아간 유권자 (0) | 2022.03.09 |

| "도장이 안찍힌다" 항의, 투표지 공개했다 고발…투표장 소동 (0) | 2022.03.09 |

| 서울 종로 최재형 vs 김영종 등 5곳서 재보선도 실시 (0) | 2022.03.09 |